The Rise of Bank Transfers During the Pandemic

When the pandemic struck, businesses in the Maldives leaned heavily into bank transfers as a contactless payment alternative. The convenience of cashless payments, even without a card terminal, kept things moving. But now, as we settle back into “normal” operations, should bank transfers remain the go-to payment method?

The Customer Experience: A Lengthy Process

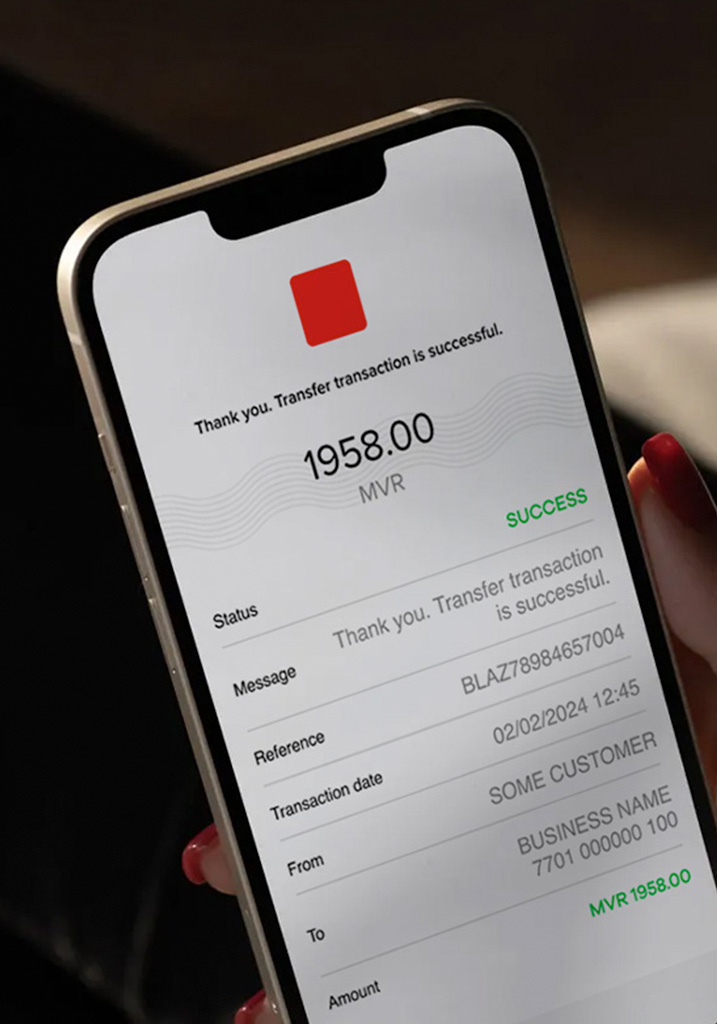

Imagine this typical scenario: a customer finishes shopping and is presented with the total. If card payments aren’t accepted, they can either pay with cash or start the process of a bank transfer, which goes like this:

- they open their banking app,

- enter the business’s account number,

- complete the transfer,

- save the receipt,

- and then forward it on Viber.

This process, though familiar, is quite a hassle.

Customers may not realize they’re going through these steps to accommodate the business’s choice to avoid card processing fees.

Fuel Suppliers: Addu City vs. Fuvahmulah City

For example, Addu City’s primary fuel supplier, City Fuel, only accepts cash or transfers, citing low profit margins as the reason they can’t support card payments. Yet nearby, Hawks in Fuvahmulah City has embraced card payments. Both cities are in the far south of the Maldives, so distance from Malé isn’t a major factor here.

So, what could be the factor?

“Making payments easy shows respect for customers' time and builds trust, turning convenience into a competitive advantage.”

Alpha Digital Share on X

The Benefits of Accepting Card Payments

It’s worth noting that the bank-provided point-of-sale (POS) services come with clear advantages. Card transactions reduce the time it takes to complete a purchase and allow businesses to offer a smoother customer experience. More so, the banks’ POS systems simplify accounting, give access to financial insights, and offer great perks, too.

Weighing Costs Against Customer Convenience

It’s understandable why businesses might avoid card fees, especially with thin margins. But as customer expectations shift, sticking with bank transfers as the main payment method can be a double-edged sword. By embracing card payments, businesses can simplify the checkout process, meet customers’ preferences, and perhaps even grow their customer base.

What’s Next? Balancing Business Needs and Customer Convenience

Ultimately, the question is, are businesses willing to balance their costs with customer convenience? Or will bank transfers continue to be the workaround that leaves customers bearing the hassle?

Below we have included useful links to proceed with: